Intriguing Details of PEO Industry’s Largest Public Firms

February 18th 2019

Because people have more interesting ways to spend their time than to pour over financial statements, I have taken it upon myself to do just that. Below are some interesting observations after looking at annual reports from the largest publicly-traded PEOs.

Risk Factors

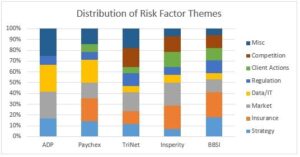

Though rarely brimming with quantitative information, the risk factors section of the 10K provides some of the most useful qualitative information about what concerns the company and what it may be doing to allay those concerns. I went through each company’s risk factor disclosures and grouped them into the following themes:

- Strategy — Encompasses business continuity failure, geographic concentration.

- Insurance — Includes concerns about a large deductible, adverse claims development on costs, and carrier failure.

- Market — Encompasses market risk, credit risk, and competition.

- “Regulation” encompasses concerns about government regulation (e.g. PPACA) or being recognized as an employer under federal or state regulations.

- Competition — Includes actions from competitors, geographic concentration of business, and management of sales force.

The following chart compares how much each risk theme is a concern for these companies:

At a high level, it seems that risk profile can largely be separated by company size, as measured by worksite employees (WSE). Larger firms, like ADP and Paychex[1], are relatively more concerned with how the market and their own handling of data privacy and cyber risk will affect their business. Smaller firms, like TriNet, Insperity, and BBSI, are relatively more concerned with how actions by their clients and competition will affect their business.

At a more detailed level, there are plenty of interesting observations:

- ADP stands out from the pack by not disclosing any risk factors related to insurance risk. (I will explain why in the next section.)

- Though not apparent from the chart, the theme of “regulation” – and specifically PPACA – was the top risk factor noted for ADP, Paychex, and TriNet, in the top 5 for Insperity, and top ten for BBSI.

Similarly, “strategy” is also a common concern for all the listed firms. And in the fine print, there are some interesting disclosures by some firms regarding changes in WSE figures and extraordinary expenses that were incurred.

Digging Deeper on Insurance Risk Factors

As noted above, ADP is the only one of the above companies to not disclose any insurance related concerns to its business. In contrast, it made up 10-20% of the risk factors disclosed by the other companies, with most being in their top five risk factors and for BBSI being their #1 and #2 risk factors. Why is ADP relatively unconcerned and BBSI extremely concerned about insurance risk? The answer lies elsewhere in each company’s annual report where they disclose details about the structure of their workers’ compensation (and health benefits) insurance programs.

According to their annual reports, each of the five companies utilizes a large dollar deductible policy for its workers’ compensation liability [2]. ADP, TriNet, and Insperity all have $1M deductible limits, while Paychex has a $1.3M limit and BBSI has a mammoth $5M limit. Combine that $5M per occurrence limit with the fact that BBSI’s business is concentrated in California, and it makes sense why BBSI would be relatively more concerned about insurance risk than its peers.

On the flip side, we still haven’t explained why ADP is less concerned about insurance risk. It has a $1M deductible just like TriNet and Insperity. The difference, as disclosed in its annual statement, is that ADP has reinsurance on its deductible layer. The effective result is that substantially all workers’ compensation losses borne by ADP’s captive is ceded to a carrier. This explains why ADP is not as concerned with insurance risk as the other firms without reinsurance on their deductible layer.

Who They List As Competitors

It’s always interesting to me who companies list as a competitor:

| COMPANY | LISTED DIRECT COMPETITORS |

| ADP | None |

| Paychex | ADP |

| TriNet | ADP, Paychex, Insperity |

| Insperity | ADP, Paychex, TriNet |

| BBSI | ADP, Paychex, TriNet, Insperity |

Apparently, ADP, as the largest public PEO in the country by WSE figures, looks down from atop the mountain and sees no rivals. Paychex is feeling good, and likely more so post Oasis acquisition, and is only looking up to the top. The remaining three – TriNet, Insperity, and BBSI – see all the other public firms as threats.

Take-Aways

- Larger PEOs have different risk factors than smaller PEOs.

- Larger PEO risks: market, data privacy, and cyber risk

- Smaller PEO risks: clients actions and competition

- All listed companies are concerned with government regulation and business strategy.

- All listed companies utilize large deductible plans for their workers’ compensation risk, with most taking $1M limits.

- ADP is the only listed company to have reinsurance on its deductible layer.

[1] Even though Paychex’s disclosure is prior to its acquisition of Oasis, I am assuming it has more than TriNet’s 317K WSE and less than ADP’s roughly 500K WSE, if not before the acquisition then most likely after.

[2] ADP uses AIG, and Insperity and BBSI use Chubb. Paychex and TriNet do not disclose their carriers.

-

March 24th 2020

COVID-19, PEOs, and the Workers’ Comp Market

In late December, I wrote an article on coming workers’ compensation (WC) trends for the…

-

March 5th 2020

A Deep Dive Into Workers’ Comp Stats

Originally published in PEO Insider (March 2020) Reproduced with permission of the National Association of…

-

October 29th 2019

Intriguing Details of the Largest Public PEOs in 2019

Because our first post was so well received, we decided to post annual updates. Below…

-

March 26th 2024

Approaching the 2024 EPLI market

It has been a while since I last shared on the EPLI environment.…

-

April 4th 2024

Explore Atlanta After 2024 Spring Meeting

SCOPE I have examined the list of 5 fun things to do in…

-

March 26th 2025

New Year, New Insights on Workers' Comp & EPLI Trends

As we step into 2025, the insurance landscape for workers’ compensation (WC) and…